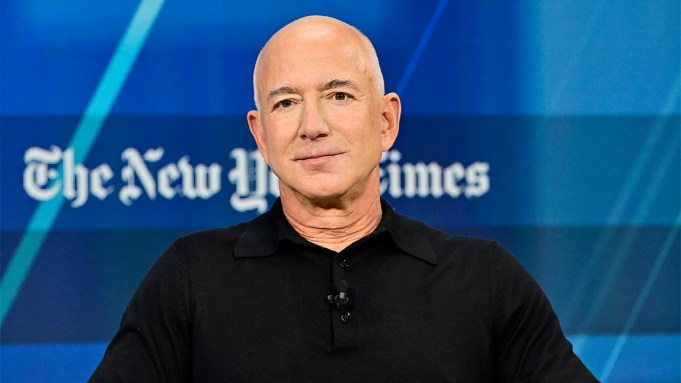

The Top 200 Art Collectors Have Lost Billions Due to Stock Market Sell-offs. In a recent turn of events, some of the most prominent art collectors in the world, including Jeff Bezos, Bernard Arnault, and Alice Walton, have suffered significant losses due to stock market sell-offs. These sell-offs were primarily motivated by investor concerns about the new Trump tariffs and various other factors. It is estimated that these top collectors have collectively lost billions on March 7 and March 10 as a result.

The art market is a multibillion-dollar industry that attracts investors and collectors from around the world. The top 200 collectors, who are often seen as trendsetters in this sector, have traditionally enjoyed substantial returns on their art investments. However, recent market fluctuations have proven that even the most prosperous and knowledgeable collectors are not immune to financial setbacks.

The sell-offs that occurred in early March sent shockwaves through the art world. Investors were wary of the potential impact of the newly implemented tariffs and other economic uncertainties. As a result, the stock market took a hit, and this downturn affected the art market as well. The value of many art pieces owned by these top collectors plummeted, causing significant losses.

These losses not only affect the collectors but also the artists and galleries involved. Many artists rely on these high-profile collectors to support and promote their work. When the market experiences a slowdown, the ripple effect is felt throughout the entire art ecosystem. Galleries may struggle to make sales, artists may struggle to find buyers for their pieces, and the overall enthusiasm and confidence in the art market may wane.

The recent stock market sell-offs have reminded us of the interconnectedness of various industries and the fact that financial instability can impact even the most seemingly unrelated sectors. In times like these, it is crucial for both collectors and artists to diversify their investments to minimize risk. Investing in multiple art forms, exploring different markets, and staying aware of the ever-evolving economic landscape can help mitigate potential losses.

In conclusion, the recent stock market sell-offs have hit the art world hard, with even the top 200 collectors suffering significant losses. These events serve as a reminder that the art market is not immune to financial turbulence. Collectors and artists alike must remain vigilant, adapt to changing circumstances, and diversify their investments to safeguard their portfolios. By doing so, they can navigate the unpredictable nature of the art market and continue to thrive in the face of adversity.